Unrivalled new business and deal origination opportunities for the structured trade & export finance community

We brought you access to the hottest deals in Structured Trade & Export Finance across the Americas!

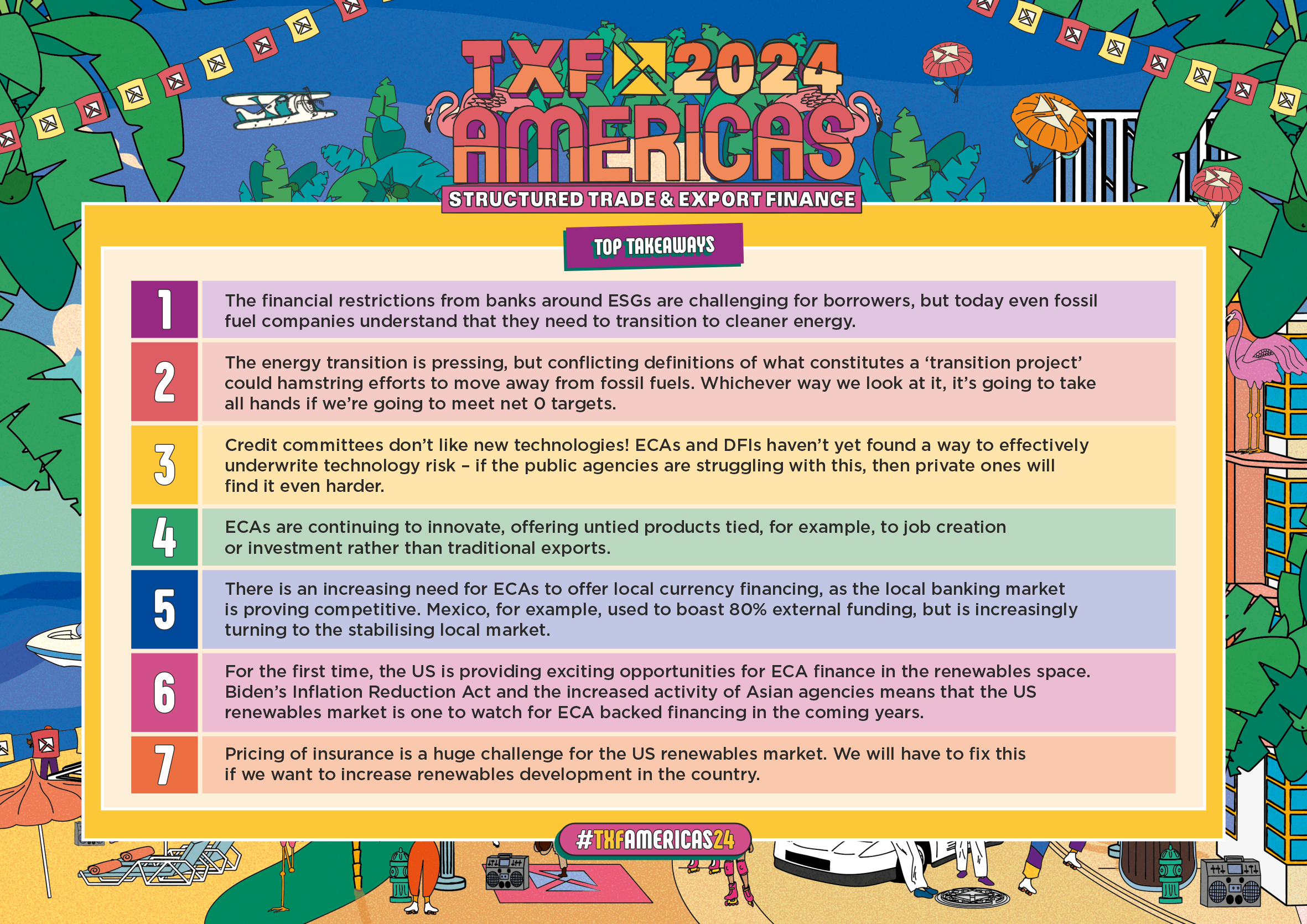

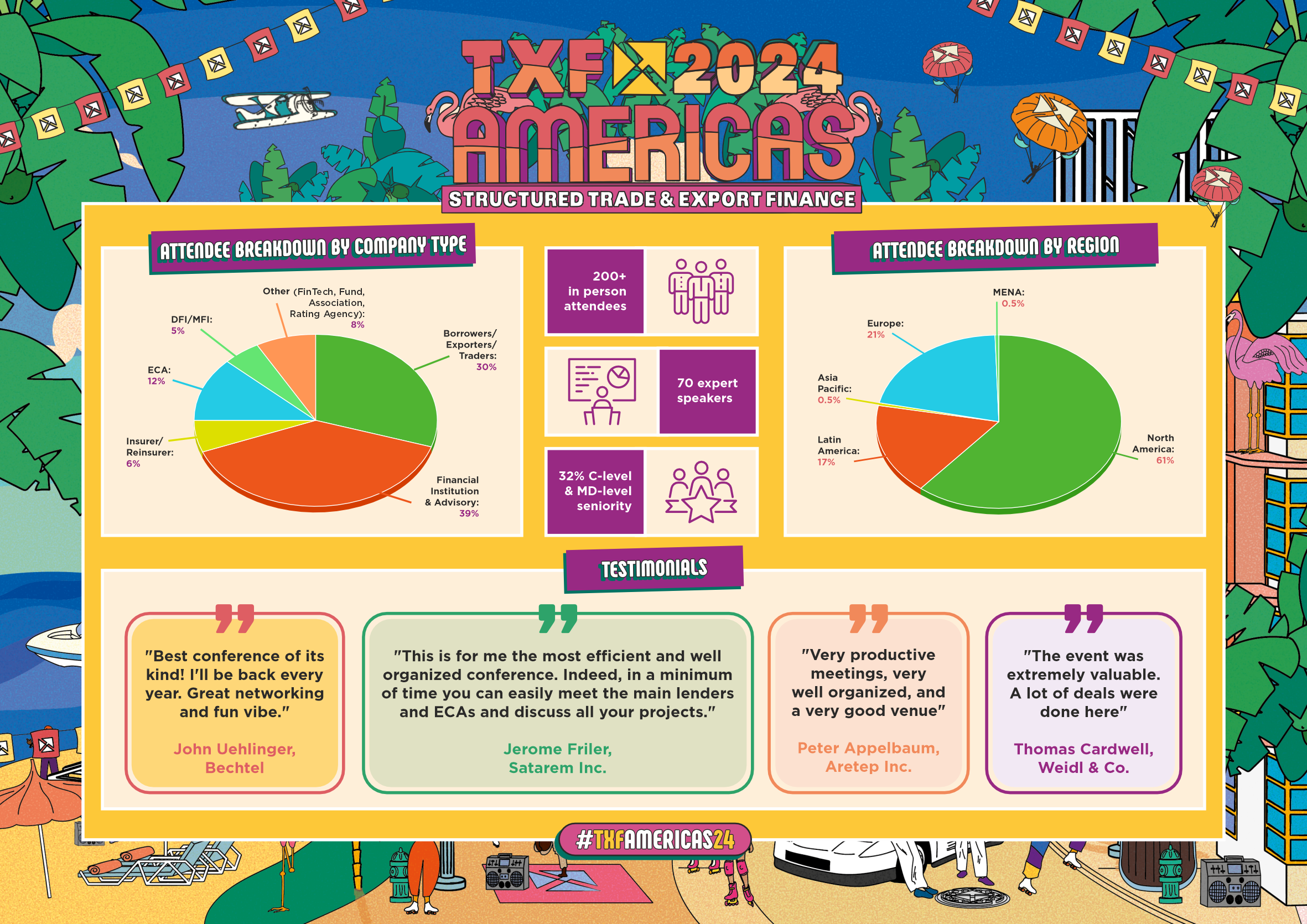

Key Takeaways from the event:

1. The financial restrictions from banks around ESGs are challenging for borrowers, but today even fossil fuel companies understand that they need to transition to cleaner energy.

2. The energy transition is pressing, but conflicting definitions of what constitutes a ‘transition project’ could hamstring efforts to move away from fossil fuels. Whichever way we look at it, it’s going to take all hands if we’re going to meet net 0 targets.

3. Credit committees don’t like new technologies! ECAs and DFIs haven’t yet found a way to effectively underwrite technology risk – if the public agencies are struggling with this, then private ones will find it even harder.

4. ECAs are continuing to innovate, offering untied products tied, for example, to job creation or investment rather than traditional exports.

5. There is an increasing need for ECAs to offer local currency financing, as the local banking market is proving competitive. Mexico, for example, used to boast 80% external funding, but is increasingly turning to the stabilising local market.

6. For the first time, the US is providing exciting opportunities for ECA finance in the renewables space. Biden’s Inflation Reduction Act and the increased activity of Asian agencies means that the US renewables market is one to watch for ECA backed financing in the coming years.

7. Pricing of insurance is a huge challenge for the US renewables market. We will have to fix this if we want to increase renewables development in the country.

Our Clients

2023 Attendees

- Wabtec Corporation

- IBT Group

- Agora Agri

- Siemens

- Liebherr-Werk Ehingen GmbH

- Nokia

- COFCO

- Aarsleff

- Engie Mexico

- Nidec ASI S.p.A.

- Satarem America Inc.

- Volvo Group Latin America

- Louis Dreyfus Company

- Ellicott Dredges

- Helvetia Resources AG

- Archer Daniels Midland

- Hitachi Energy

- Rescom Holdings

- Olam Agri

- Gerald Group

- Sumitomo Corporation

- UGT Renewables

- Acclaim Energy Mexico

- Aretep

- Ojas Commodities

- Jaini Chemicals and Pharmaceuticals

- CHG Meridian Mexico SAPI de CV

- Siemens Energy

- Kansas City Southern de Mexico

- Cinepolis

- General Electric

- John Deere

- Mitsubishi Corporation

- International Materials

- Ocean Partners

- Bechtel

- Jebsen & Jessen Industrial Solutions GmbH

- OPCS GROUP CORPORATION

- Cargill

- Bechtel Enterprises

- Cosapi

- Volaris

- Polish Nuclear Power Plants

- Fortescue Metals Group

- GE Capital

- JP Morgan

- Private Export Funding Corporation (PEFCO)

- DekaBank

- Credit Agricole CIB

- CNB Bank

- Deutsche Leasing

- HSBC

- KfW IPEX-Bank

- Societe Generale

- Sumitomo Mitsui Banking Corporation (SMBC)

- Landesbank Baden - Wurttemberg (LBBW)

- Bank of America Merrill Lynch (BAML)

- DZ Bank

- JPMorgan Chase

- CaixaBank

- Commerzbank

- Mizuho

- Intesa Sanpaolo

- BayernLB

- GE Energy Financial Services

- Santander

- ANZ

- Citi

- BNP Paribas

- Deutsche Bank

- Standard Chartered

- Banco Pichincha

- Financial Services Group

- TD Securities

- BBVA

- BCI Miami

- US EXIM BANK - Export-Import Bank of the United States

- Finnvera plc

- SACE

- EKF

- SERV - Swiss Export Risk Insurance

- Bpifrance

- Export and Investment Fund of Denmark (EIFO)

- EKF - Denmark?s Export Credit Agency

- EDC - Export Development Canada

- Euler Hermes

- EXIM

- Vantage Risk

- Validus Speciality

- Sovereign Risk Insurance Ltd.

- BPL Global

- Blenheim Underwriting Limited

- Beazley

- Howden CAP

- Allied World Insurance Company

- DLA Piper

- Allen & Overy

- Hogan Lovells

- Ministry of Finance Mexico

- UK EMBASSY COLOMBIA

- Ministry of Finance Mexico

- UK EMBASSY COLOMBIA

- Global Recovery Group

- Mitsubishi Power Americas

- Exile Group

- TXF

- Global Recovery Group LLC

- Women in Maritime Association Carribean

- ImpactA Global

- CC Solutions

- Veridapt

- Austrian Federal Economic Chamber

- SGT Fund

- Pino Capital

- Fitch Ratings

Venue

TXF Americas 2024 took place at the glamorous EAST Miami hotel!

788 Brickell Plaza, Miami, FL 33131, United States

View mapAccommodation

Discounted hotel rooms are always available for guests at our events.

Networking Activities

ICE BREAKER DRINKS: Guests enjoyed the chance to relax and mingle at our casual ice-breaker drinks.